|

|

|

|

|

Scroll down to view projects

Current Exhibition

OH MY GODDESS!

27 April to 20 May 2023

Martin Browne Contemporary Sydney

click here to view exhibition

Aussie Icon Linda Jackson 2023

Set of 10 nesting dolls

Acquired by the National Portrait Gallery, Canberra

Aussie Icon Jenny Kee 2022

Set of 10 nesting dolls

Acquired by the National Portrait Gallery, Canberra

JK Portrait of Jenny Kee 2022

Set of 15 nesting dolls

Martin Browne Contemporary

SYDNEY CONTEMPORARY

8 - 11 SEPTEMBER 2022

Dollface

Tamworth Regional Gallery

24 th June 2022

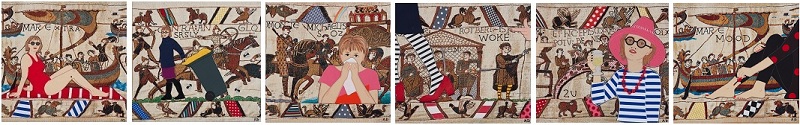

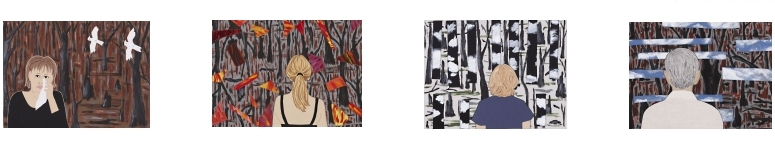

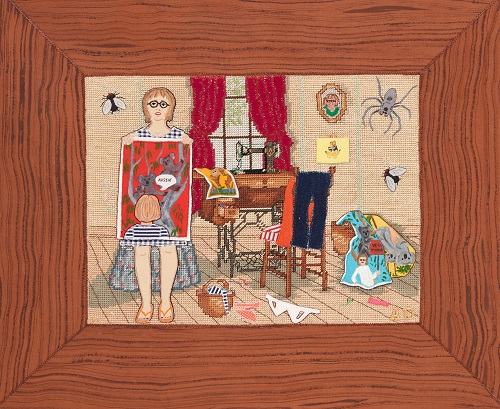

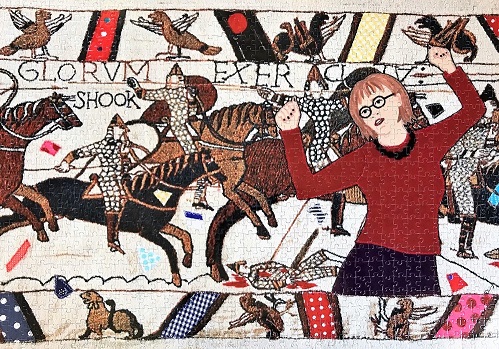

Recent Exhbition It's All About Me Benalla Art Gallery 12 February - 3 April 2022 click here to view  Bathurst Regional Art Gallery click here to view Everyday Me Installation  click here to view IT'S ALL ABOUT ME! WHAT DO WE WANT?  Archie Plus Art Gallery Of NSW 2021 PICTURE ME  20 August - 13 September 2020 Martin Browne Contemporary Sydney click here to view exhibition PUZZLE PROJECT  click here to view

HELP ME Martin Browne Contemporary Sydney 27 June to 21 July 2019 click here to see fundraising page EXTRA Martin Browne Contemporary Sydney 23 August to 16 September 2018 click here to view exhibition via Martin Browne Contemporary site

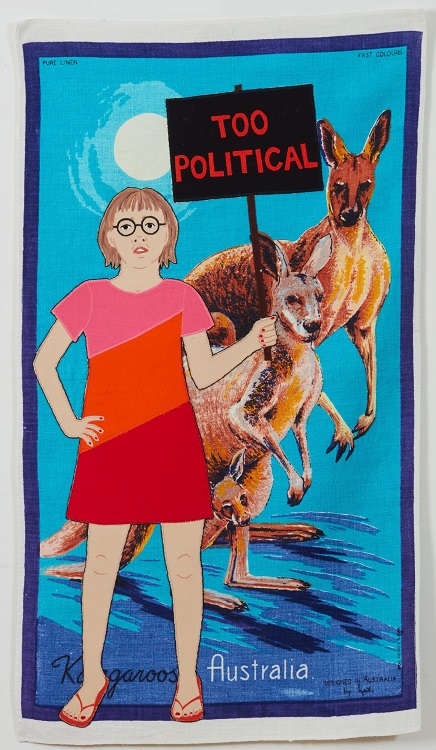

LOOK OUT Martin Browne Contemporary 25 June - 19 July 2015

Click here to email for more information about these works. Available to view at Martin Browne Contemporary Sydney

Lil' Adrienne Click here to email for more information

FLORA AND FAUNA Penrith Regional Gallery 2010 Selected works 2009 - 1996 page currently under construction

Images |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||